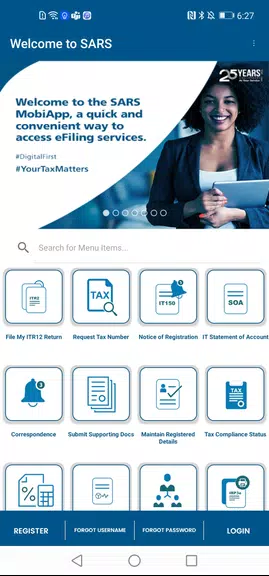

The SARS Mobile eFiling app revolutionizes tax filing in South Africa, offering a user-friendly mobile solution for completing and submitting Income Tax Returns. This innovative app empowers taxpayers to access their annual returns, conveniently save and edit them offline, utilize a built-in tax calculator for assessment estimations, and track their submission status. Experience the ease and security of managing your tax obligations anytime, anywhere.

Features of the SARS Mobile eFiling App:

- Unmatched Convenience: File your annual Income Tax Return directly from your smartphone, tablet, or iPad – quick, simple, and efficient.

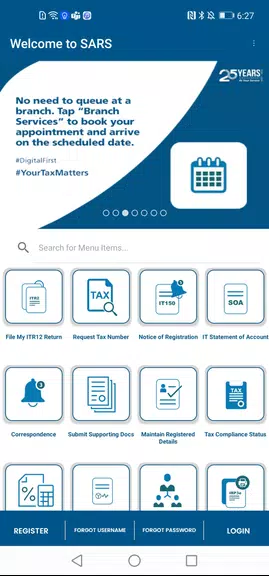

- Anytime, Anywhere Access: Manage your taxes with unparalleled flexibility, accessing the app whenever and wherever you need it.

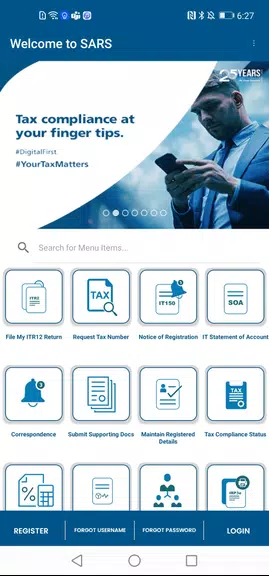

- Robust Security: Rest assured knowing your information is securely encrypted, protecting your data throughout the filing process.

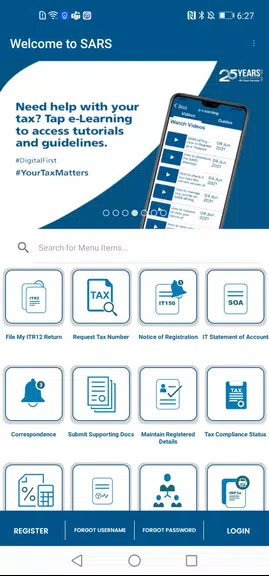

- Integrated Tax Calculator: Estimate your assessment outcome using the app's built-in calculator, aiding in effective financial planning and budgeting.

Frequently Asked Questions:

- Is the SARS Mobile eFiling app secure? Yes, the app employs robust security measures, encrypting all submitted information to safeguard user data.

- Can I access past tax returns through the app? Yes, you can view a summary of your Notice of Assessment (ITA34) and Statement of Account (ITSA) within the app.

- Can I use the app to file business taxes? Currently, the app is designed for individual taxpayers filing personal Income Tax Returns only.

Conclusion:

The SARS Mobile eFiling app is an indispensable tool for South African taxpayers seeking a streamlined and efficient tax filing experience. Its convenient features, robust security, and user-friendly design make tax filing easier than ever before, regardless of your experience level. Download the app today and simplify your tax obligations on the go.