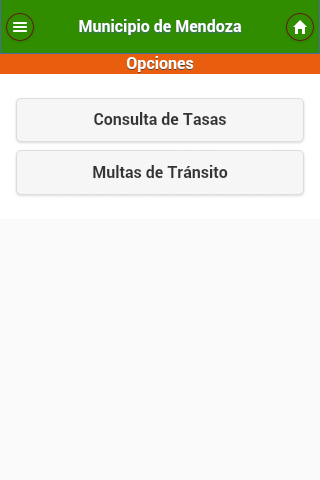

Key Features of a Tasas y Multas System:

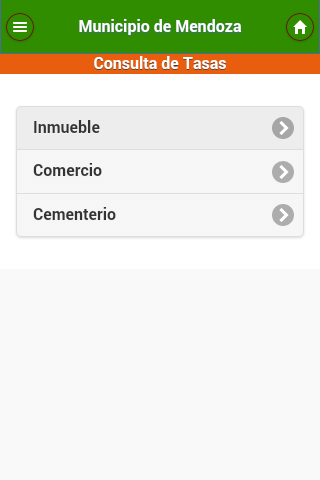

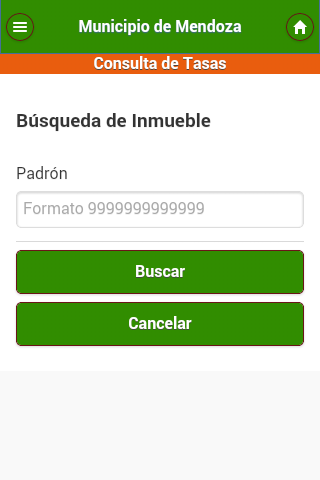

- Convenient Payment Methods: Easily pay municipal fees for property, cemeteries, advertising, and fines. Receive email receipts and generate electronic payment information for future use.

- Online Accessibility: Make secure online payments through established networks like Banelco and Link Payments, eliminating the need for in-person visits.

- Mobile Integration: Seamlessly integrate with "BanelcoMOVIL" and "Link Cell" mobile applications for enhanced convenience.

- Accrual and Payment Plan Management: The system calculates accruals and provides details on payment plan deadlines and enforcement procedures.

Frequently Asked Questions:

- Data Security: Online payments are protected using robust security measures to safeguard personal and financial information.

- Fines from Other Authorities: This system specifically handles municipal fees and fines; it doesn't cover penalties from other jurisdictions.

- Email Receipt Delivery: Receipts are typically emailed immediately after payment, though minor delays may occur.

▶ Understanding Tasas (Fees):

Tasas are charges for using specific services or completing administrative processes. Examples include:

- Bank Fees: Account maintenance, transfers, and transactions.

- Service Fees: Utilities (water, electricity, waste management).

- Municipal Taxes: Local government services (road maintenance, public safety).

Tasas are generally predictable and follow established guidelines, allowing for budgeting.

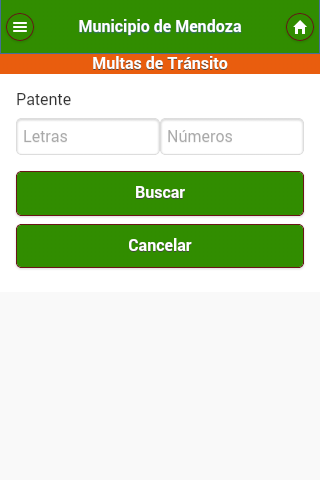

▶ Understanding Multas (Penalties):

Multas are fines levied for violating laws, rules, or regulations. Unlike fees, they are punishments for non-compliance. Examples include:

- Traffic Fines: Speeding, running red lights, etc.

- Tax Penalties: Late payments or incorrect filings.

- Business Fines: Non-compliance with labor laws, environmental regulations, or safety standards.

Multas aim to deter unlawful behavior and promote adherence to regulations.

▶ Effective Tasas y Multas Management:

- Compliance: Follow rules and regulations to avoid penalties.

- Deadline Awareness: Meet deadlines for payments and submissions.

- Statement Review: Regularly review financial statements to identify unexpected fees.

- Local Regulations: Understand the specific tasas and multas structures in your area.