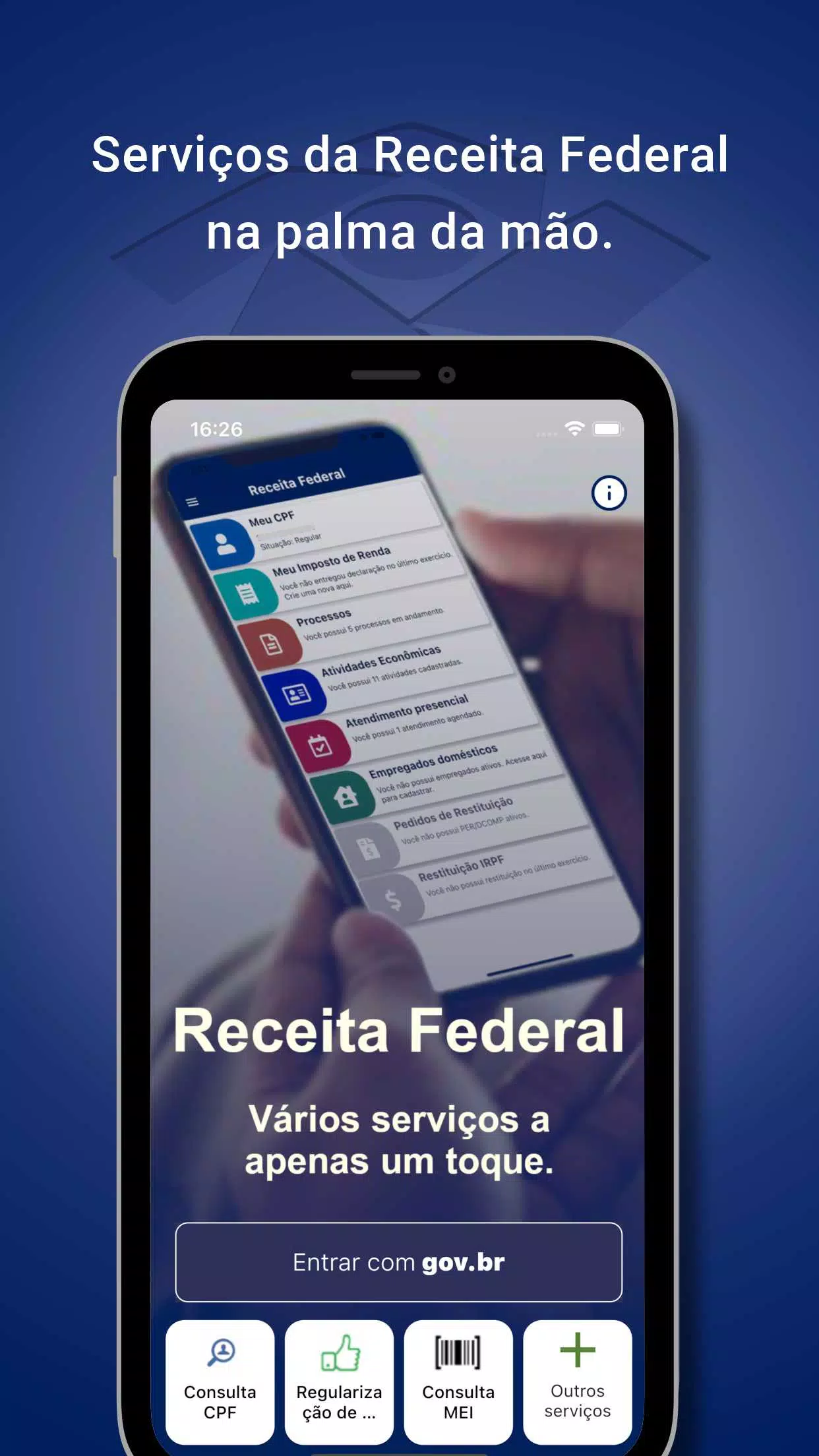

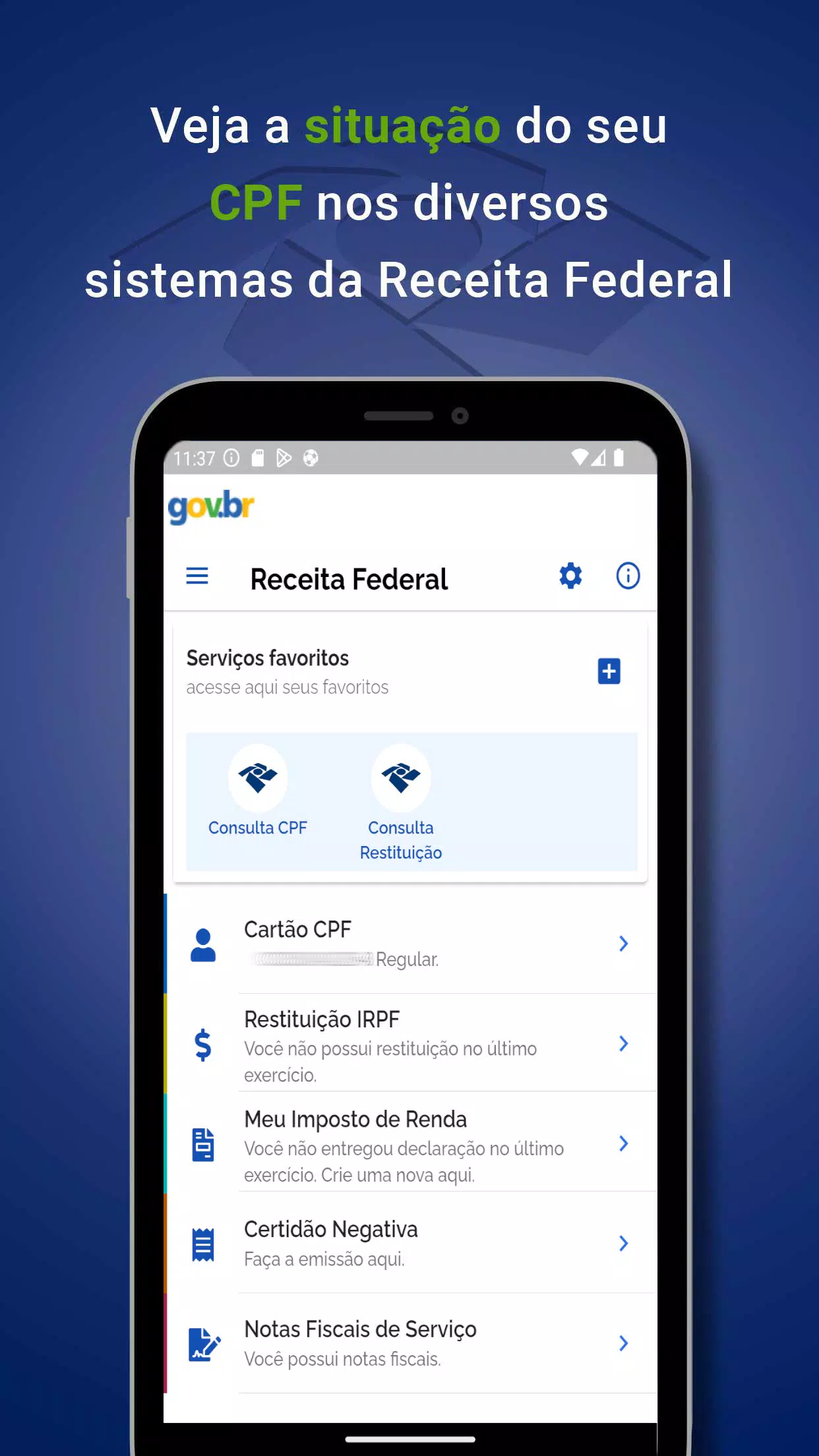

This application provides a comprehensive overview of CPF information across various Brazilian Federal Revenue systems. Some services require downloading additional Federal Revenue applications, as indicated by an asterisk (*).

Key features include access to:

- CPF card details

- Negative debt certificate

- IRPF (Income Tax) refund status

- Income tax declarations*

- In-progress processes*

- Economic activities (CAEPF)

- Tax schedules (SAGA)*

- eSocial (domestic employees)*

- Business information (including MEI)*

- Import details (declarations and Bills of Lading)

- Refund requests (PERDCOMP)

- Service invoices

- Health recipe information

Beyond CPF information, users can also access: CNPJ registration details, MEI status, CNAE codes, NCM tables, RFB unit information, legal regulations, Sicalc, import simulation tools, and more.

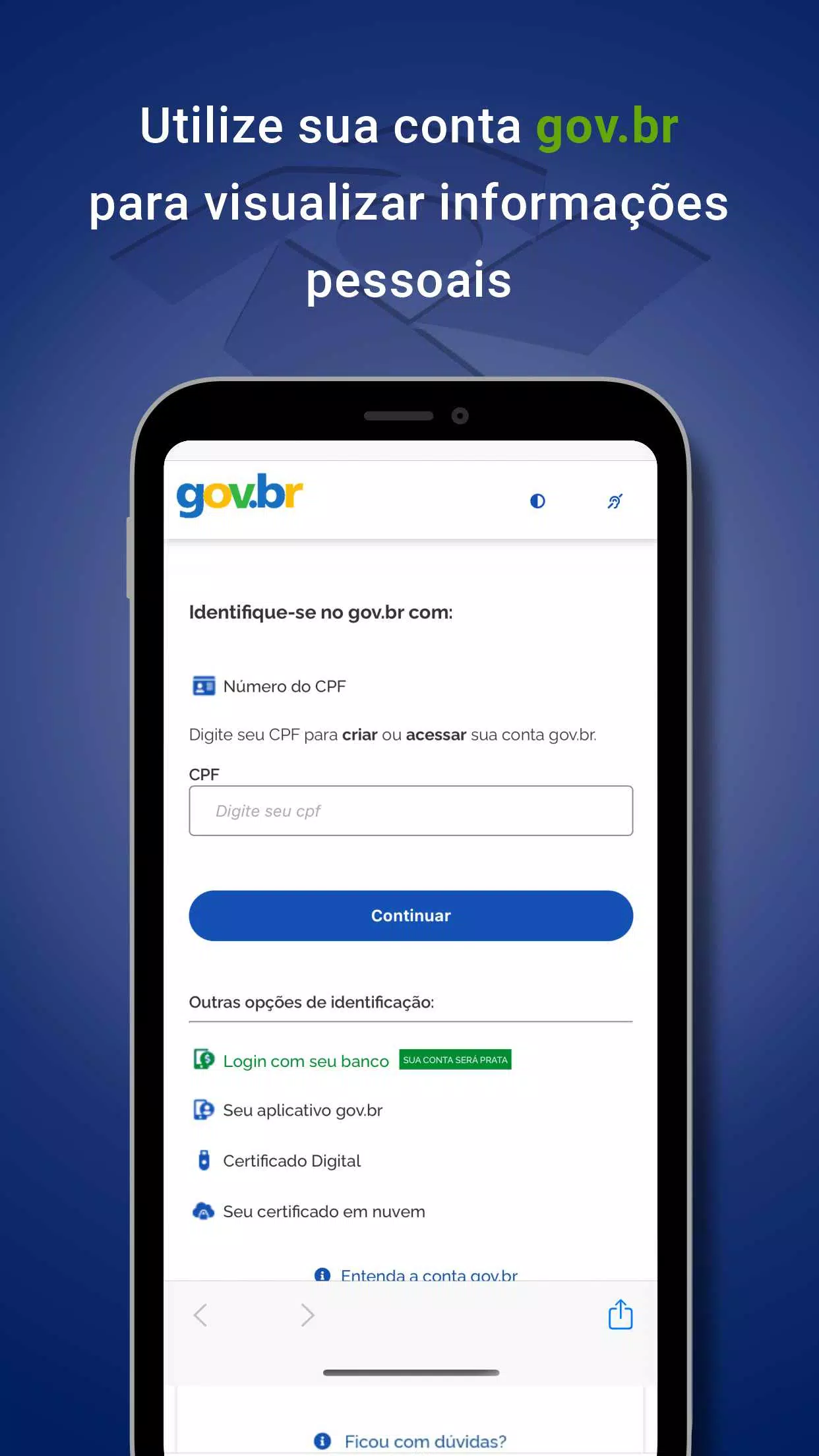

Access levels vary based on user authentication:

-

Unauthenticated users (without gov.br login): Access is limited to basic information. A CAPTCHA is required for each query, and saving favorites is not available.

-

Authenticated users (with gov.br login): CAPTCHA verification is eliminated, and users can save frequently accessed numbers as favorites for easier future access. Future updates will include alerts for account activity. Access to third-party data is limited to basic information, while access to personal data ("My data") is complete.